Arizona Unclaimed Money

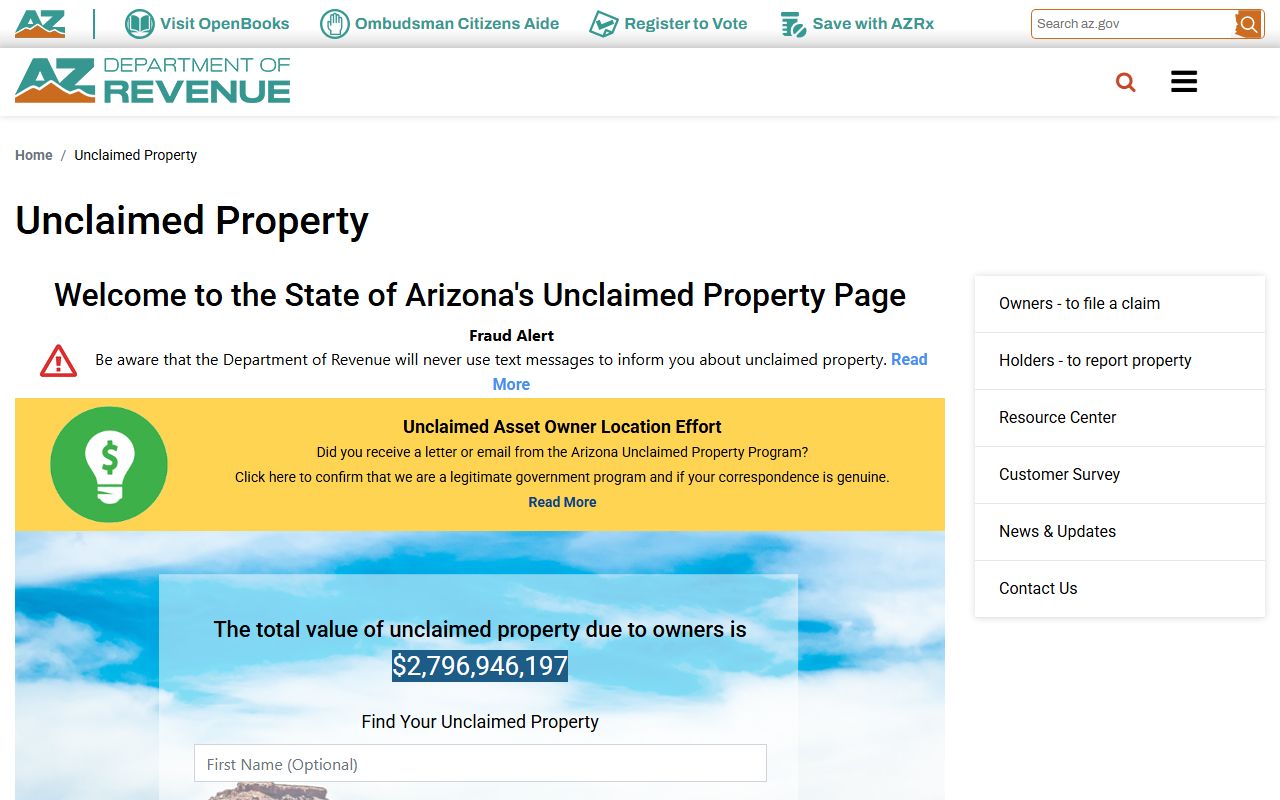

Arizona holds over $2.2 billion in unclaimed money waiting for its rightful owners. The state manages all unclaimed property through the Arizona Department of Revenue, and you can search for lost funds at no cost. One in seven Arizonans may have money to claim, and property stays on file for 35 years after it gets reported to the state.

Arizona Unclaimed Money Quick Facts

How to Search Arizona Unclaimed Money

The search process is fast and free. You can look up Arizona unclaimed money through the official state portal at missingmoney.com in just a few steps. Enter your first and last name, then pick Arizona from the state list. The system will check for any funds linked to your name. Try different name forms if you have used maiden names or nicknames in the past. Business owners should also search their company names since funds can be held under either type of account.

Results show up right away. You will see the name of the holder and the type of property, but the dollar amount stays hidden until you file a claim. This is a privacy rule, not a limit on what you can access. The Arizona Department of Revenue set up this system to protect claimants from fraud. Once you spot a match, you can start your claim online or print the forms to mail in.

The official search portal at missingmoney.com connects to the Arizona Department of Revenue database, which is the only source for state unclaimed property records. You can access this site any time of day from home or from a library computer if you do not have internet access at your house. The portal works on phones and tablets as well.

The screenshot above shows the main search page where Arizona residents can look up unclaimed property for free.

Types of Unclaimed Money in Arizona

Arizona holds many types of unclaimed property. The most common are old bank accounts that went dormant after the owner stopped making deposits or withdrawals. Checking and savings accounts become unclaimed after three years of no activity. The bank must try to reach you first, but if they fail, the funds go to the state. CDs and money orders follow the same rule.

Uncashed checks make up a large part of the unclaimed money pool. Payroll checks that workers never cashed become unclaimed after one year. Vendor checks, refund checks, and dividend checks all end up in the state database if no one cashes them. Even tax refunds can become unclaimed if the check gets lost in the mail or the person moves and forgets to update their address with the IRS or state tax office.

Life insurance is another big source of Arizona unclaimed money. When a policy matures or the insured person dies, the insurance company must pay out. If they cannot find the beneficiary, the money goes to the state after a set period. Insurance proceeds, casualty payments, and annuity funds all fall into this group. The dormancy period for matured life insurance is three years, while death benefits become unclaimed after one year.

Arizona also holds securities like stocks, bonds, and mutual fund shares. Stock splits, dividend payments, and dissolution proceeds can all become unclaimed property. Safe deposit box contents get held too, though the state may sell some items at auction after two years. Utility deposits and customer credit balances round out the list of common property types held by the Arizona Department of Revenue.

Arizona Department of Revenue Unclaimed Property

The Arizona Department of Revenue runs the state unclaimed property program. This is the only agency that handles unclaimed money in Arizona. Counties and cities do not run their own programs. All unclaimed funds from anywhere in the state go to ADOR in Phoenix. The agency collects, safeguards, and returns property to rightful owners.

You can reach the Unclaimed Property Unit by phone at (602) 364-0380 if you are in the Phoenix metro area. A toll-free line is also open at (877) 492-9957 for callers from other parts of the state. Staff answer calls Monday through Friday from 8:00 AM to 5:00 PM. You can also email questions to UnclaimedProperty@azdor.gov and expect a reply within a few business days.

The mailing address for claims is PO Box 29026, Phoenix, AZ 85038-9026. If you need to drop off documents in person, go to the ADOR lobby at 1600 W. Monroe Street in Phoenix. Walk-in service is available during normal business hours. Staff can answer questions and help you with the claim process face to face. Bring photo ID and any documents that prove your identity and address.

How to Claim Arizona Unclaimed Property

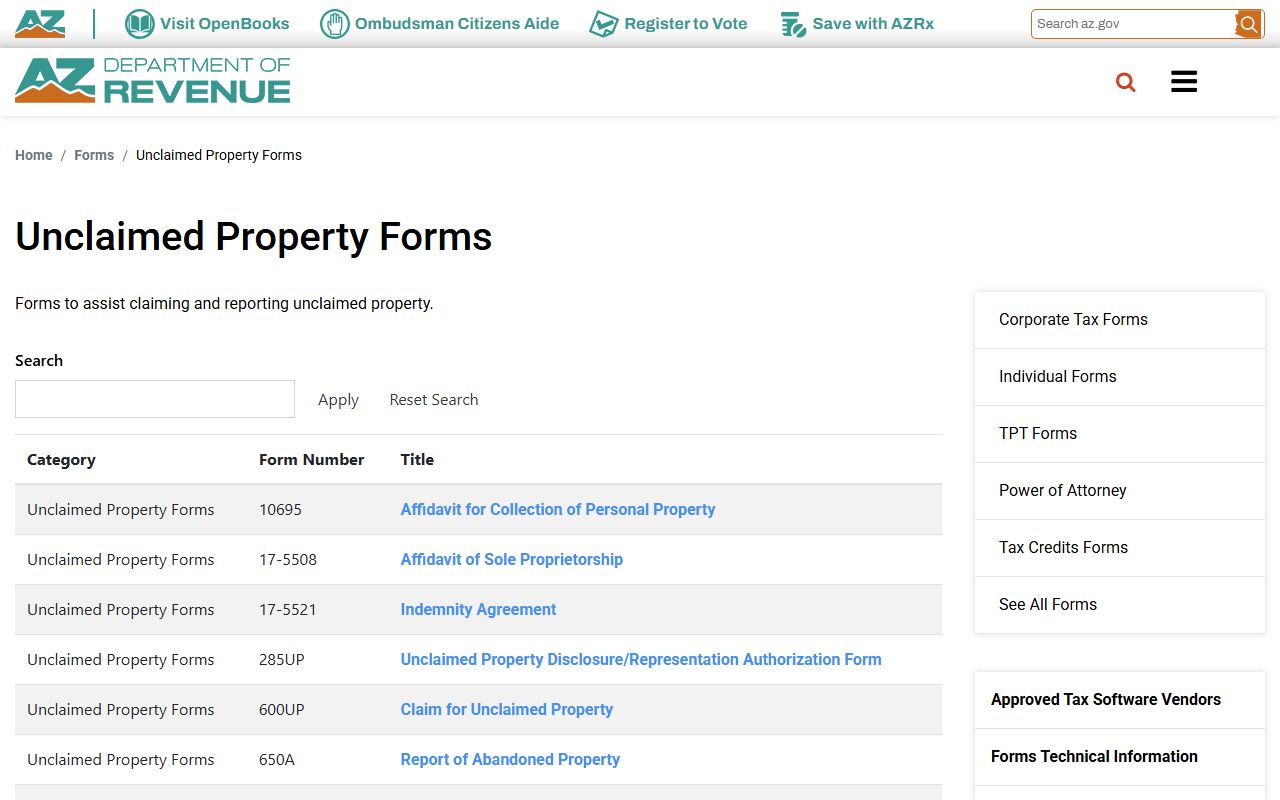

Filing a claim is simple. First, search for your name on missingmoney.com and find the property you want to claim. Click on the entry to see more details. You can then start a claim online or print the right form to mail in. Arizona uses four main claim forms depending on who is filing and what type of property is involved. All forms are available at azdor.gov/forms/unclaimed-property-forms.

Form 600A is for original owners claiming their own property. Use this if you are the person whose name appears on the account. Form 600B is for heirs or beneficiaries claiming for someone who has died. You will need extra documents like a death certificate and proof of your right to inherit. Form 600C handles business claims, while Form 600D is for agents filing on behalf of a living owner.

Every claim needs proof of identity and proof of ownership. A clear copy of your driver's license, passport, or state ID works for identity. For ownership, you need at least one document that ties you to the address where the property was reported. Utility bills, tax returns, credit reports, lease agreements, and bank statements all work well for this purpose. The more documents you provide, the faster your claim will process.

Claims for deceased owners require more paperwork. You must include a certified death certificate with every heir claim. If the person had a will, include a copy. If a court appointed a Personal Representative for the estate, include Letters of Office certified within the past 60 days. Estates worth over $75,000 after liens must go through court administration before heirs can claim the funds.

Arizona Unclaimed Property Laws

Arizona Revised Statutes Title 44, Chapter 3 governs unclaimed property in the state. Sections 44-301 through 44-340 cover everything from definitions to claim procedures to penalties for fraud. These laws spell out how long holders must wait before reporting property, what documents claimants need, and how the state must handle funds it receives. The legislature updates these rules from time to time.

Dormancy periods vary by property type. Bank accounts, CDs, and money orders become unclaimed after three years of no owner contact. Wages and payroll checks have a shorter period of just one year. IRA and Keogh accounts become dormant after two years. Traveler's checks have the longest period at 15 years since people often hold them for long trips they never take. Gift cards are exempt from the unclaimed property law in Arizona.

The claim window in Arizona lasts 35 years. This is one of the longest in the nation. You have over three decades to search for and claim your property after it gets reported to the state. Safe deposit box contents are the exception. The state may auction items from a box after holding them for two years. Heirs claiming escheated estates have just seven years from the date ADOR received the funds.

Fees for Arizona Unclaimed Money Claims

There are no fees to search or claim your property. The Arizona Department of Revenue does not charge anything to look up funds or to file a claim. Processing is free as well. ADOR will never ask for your credit card or bank account details. If anyone asks you to pay to claim your money, it is a scam. The state provides this service at no cost to the public.

Some people use finder services to help locate and claim unclaimed money. Arizona law caps finder fees at 30 percent of the property value under ARS 44-327. However, this cost is often not worth it. About 75 percent of accounts in the database are worth less than $100, so a finder fee would eat up most of the money. You can do the search yourself for free in just a few steps online.

Note: ADOR sends payment by physical check, which arrives within 30 days of claim approval.

Avoiding Arizona Unclaimed Money Scams

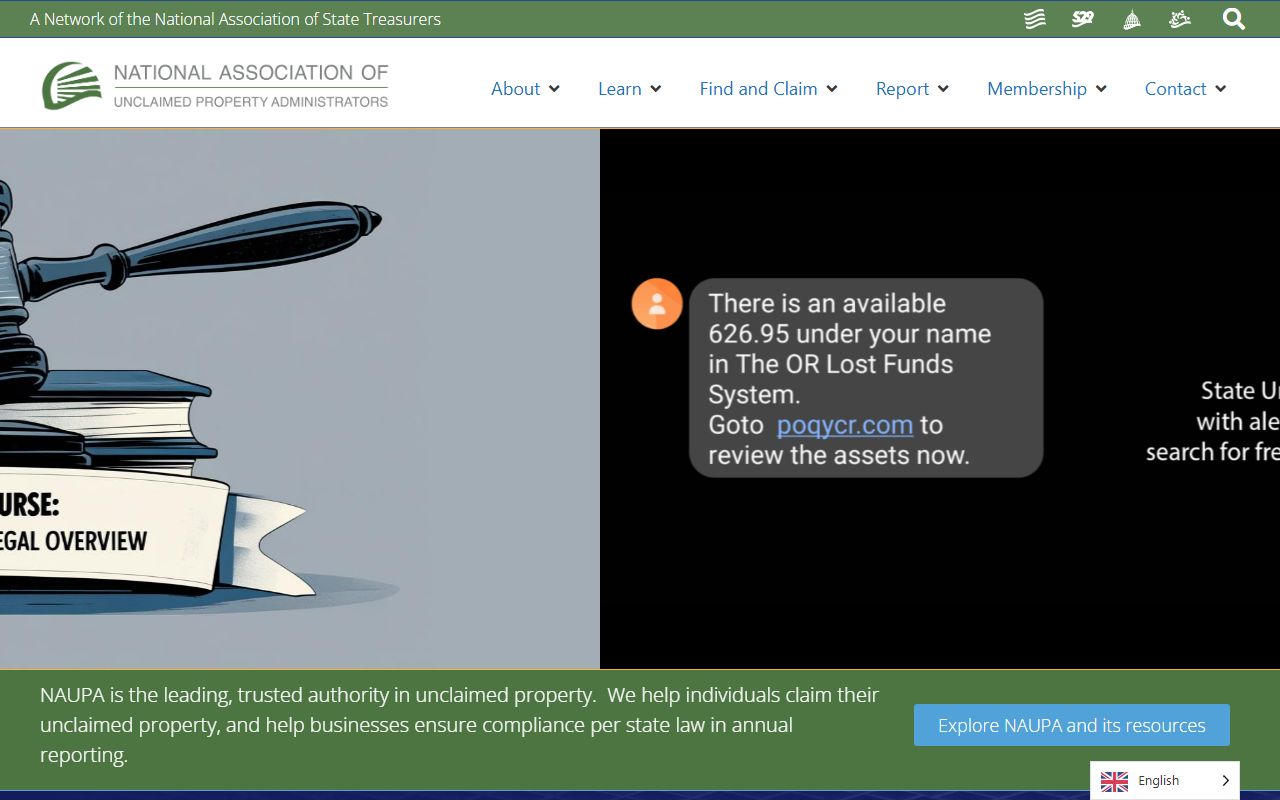

Scammers target people who may have unclaimed money. They send letters, postcards, or text messages claiming you have funds to collect. Then they ask for a fee or for your bank account number to "deposit" the money. This is fraud. Arizona never uses text messages to contact people about unclaimed property. Official outreach comes only from @azdor.gov email addresses.

Watch for these warning signs:

- Requests for payment to release your funds

- Phone calls asking for your Social Security number

- Letters that include the exact amount of your property

- Pressure to act fast or lose the money

- Contact by text, fax, or postcard

Real letters from Arizona do not include the dollar amount or source of your property. That information is kept private. If you get a call from someone claiming to be from ADOR, hang up and call the official number at (602) 364-0380 to verify. Report suspected fraud to the Federal Trade Commission at reportfraud.ftc.gov and to the Arizona Attorney General.

Processing Times for Arizona Claims

Standard claims take about 90 days from the date ADOR gets your paperwork. Stock and mutual fund claims can take up to 120 days since they need extra steps to liquidate the shares. You should get an email acknowledgment within 14 business days after you mail your claim. If you do not hear anything, wait at least two weeks before calling to check the status.

Complex heir claims take longer. If multiple family members are claiming the same property, or if the documents are incomplete, expect delays. Claims with missing paperwork get put on hold until you send what is needed. The best way to speed things up is to include all required documents with your first submission. Read the claim form instructions carefully and double check that you have everything.

After ADOR approves your claim, payment arrives within 30 days by physical check. The state does not offer direct deposit for unclaimed property payments. Make sure your mailing address is current when you file so the check goes to the right place.

Searching Other States for Unclaimed Money

If you lived or worked in other states, you may have unclaimed money there too. Property reports to the state of your last known address, not where you live now. Someone who grew up in California and moved to Arizona should search both states. The unclaimed.org website run by NAUPA lets you search multiple states at once. This is a free service with no fees attached.

Think about all the places you have lived over the years. College towns, first apartments, and short-term rentals all count. Employers you worked for in other states may have reported unclaimed wages under an old address. Utility companies, landlords, and insurance firms do the same. A full search covers every state where you had financial accounts or received mail.

Browse Arizona Unclaimed Money by County

All Arizona counties defer unclaimed property to the state program. County treasurer offices handle property taxes and excess proceeds from tax lien sales, but regular unclaimed money goes through ADOR. Pick a county below to find local treasurer contact info and resources.

Arizona Unclaimed Money in Major Cities

Residents of all Arizona cities use the state ADOR portal to search for unclaimed money. Pick a city below to learn more about local resources and how to search for lost funds in that area.